Motor Vehicle FAQ

Frequently Asked Questions

When are property taxes due?

Real estate and property taxes such as trailers, etc. are broken into halves. First half or all is due December 20th. Second half is due May 10th. If late, interest and fees will be added daily.

Taxes for your vehicles are paid when you renew your registration.

I lost my title. What do I do?

If your vehicle has a lien on it and it shows in the system, it is held electronically with the state. A title with a lien cannot be released until a lien release is processed at your county office. Those who don’t have a lien, a duplicate title form (TR-720B) can be filled out and sent to your county office for $10.

Do I get a refund for my current plate?

If you have moved out of state and your plates are still valid, then you can mail your plate, KS registration, copy of out of state registration, copy of out of state driver’s license, and your social.

If still in Kansas, bring in your plate with current KS registration.

Do I tag my boat?

The county clerk can register your boat. If you want to tag the trailer, you will need to bring in a title and bill of sale, along with the insurance of the trailer or towing vehicle, if the trailer is over 2000Ibs loaded (optional if under).

Can I get a special plate?

Yes! We have two options when it comes to the plates. We have plates with different designs and plates that you can personalize with words and numbers.

Personalized plates are $45.50 for 5 years. Every 5 years the design of the plate will change and will be switched at your renewal time.

You can find the special design plates here. The prices are different for each one.

What to bring for my new vehicle?

If bought in KS: title, sales tax receipt or bill of sale, documents from dealership, previous plate registration if transferred, insurance and payment.

If bought out of state: title, inspection document from sheriff’s office or highway patrol, bill of sale, documents from dealership, previous plate registration if transferred, insurance and payment.

Note: Bring your title and your vehicle to the vin inspection.

Antique vehicles?

Antique vehicles must be 35 years or older. Antiques will have a permanent registration that will be paid once when you come in and register it. These will not appear on the renewal forms you get when it's time to renew. You will receive a statement in November for the property tax. Vehicles 1981 and older will be charged $17 for property and 1982 and newer will be $29.

Where do I get my Vin Inspectin?

Dickinson County Sheriff's Department can do inspections for vehicles that have a clean out-of-state title Monday through Friday. They cannot do inspections on vehicles that have an antique, non-highway, salvage or rebuilt salvage title.

A Highway Patrol Officer comes on Wednesdays between 9:30 a.m. - 11:00 a.m. and can inspect vehicles that have an out-of-state, non-highway, rebuilt salvage, salvage, or an antique title. They are parked in the west parking lot on Texas St and Buckeye.

Note: Bring your title and your vehicle to the VIN inspection.

Contact Us

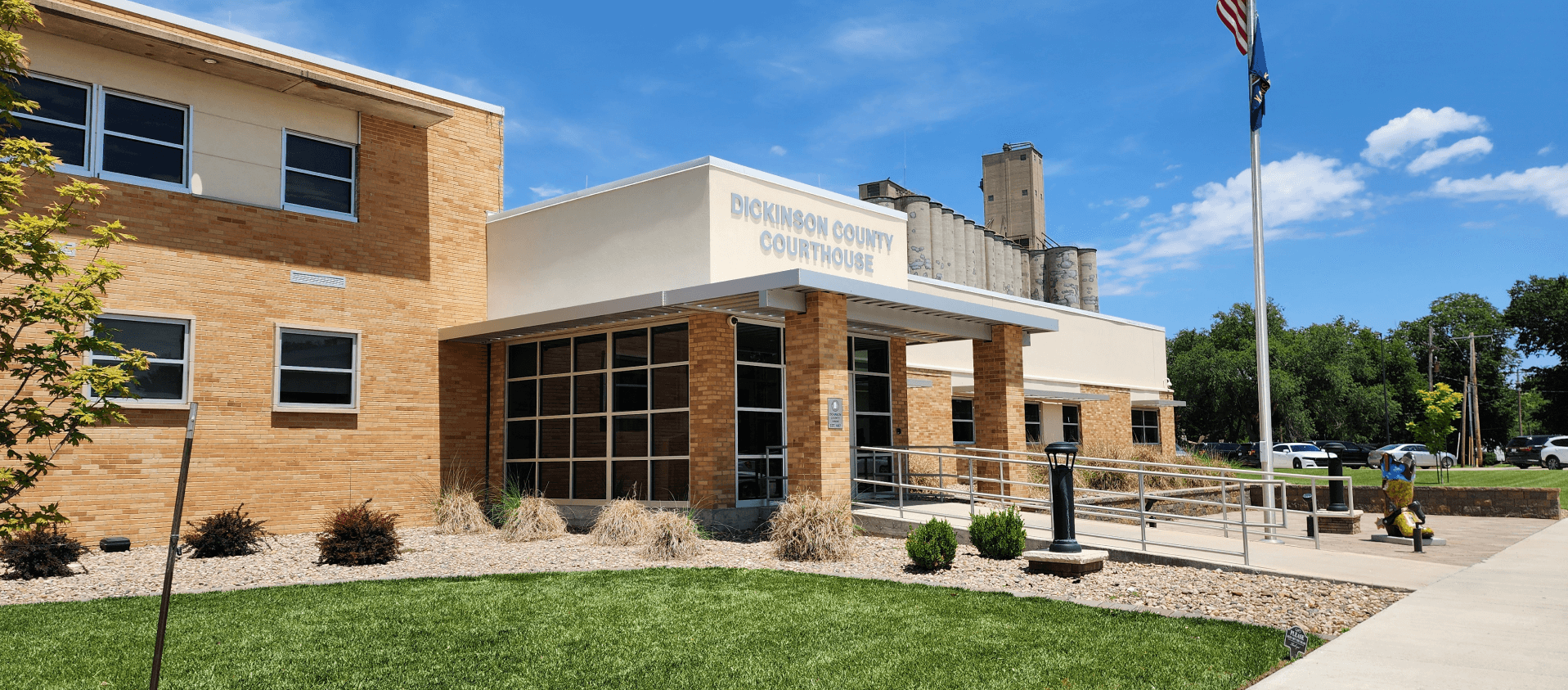

Location

109 E. 1st St, Suite 209, Abilene, KS 67410

Phone

785-263-3231

Office Hours

8:00 am - 4:30 pm